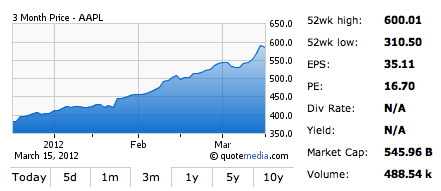

Apple Inc (AAPL) shares have hit an all-time high of $600.01/ share (before closing for the day at $585.56/ share), giving the company a $545 billion valuation, making it the largest company in the world in terms of market capitalization. This happened right after the first batch of “the new iPad” was sold in Australia (from telecom company Telstra’s stores); soon to be followed by sales in Japan, Germany and the US, from retailers like WalMart, Best Buy & Radio Shack apart from Apple’s own Apple Stores.

Apple Inc (AAPL) shares have hit an all-time high of $600.01/ share (before closing for the day at $585.56/ share), giving the company a $545 billion valuation, making it the largest company in the world in terms of market capitalization. This happened right after the first batch of “the new iPad” was sold in Australia (from telecom company Telstra’s stores); soon to be followed by sales in Japan, Germany and the US, from retailers like WalMart, Best Buy & Radio Shack apart from Apple’s own Apple Stores.

The company shares reached $500/ share only a month back and the share price has jumped 44% this year alone.

Apple could be valued even higher, according to Morgan Stanley Analyst Ms. Kathryn Huberty, who revised her target price from $515 to $720, predicting that the company would go to $960 (or higher) on a $80 Earnings Per Share (EPS) in 2013. This is based on a Price-Earning Ratio (P/E) of 12, which is at the lower end of Apple’s historical forward P/E (currently at approx. 17). Morgan Stanley is not the only firm revising their prices upwards, earlier Piper Jaffray and recently Oppenheimer & UBS also have revised their target prices for AAPL. I am sure, others institutions will soon follow suit. IF Ms. Huberty’s price predictions for 2013 come true, that would give Apple Inc. a market valuation to the tune of a mythical $1 trillion!

Apple could be valued even higher, according to Morgan Stanley Analyst Ms. Kathryn Huberty, who revised her target price from $515 to $720, predicting that the company would go to $960 (or higher) on a $80 Earnings Per Share (EPS) in 2013. This is based on a Price-Earning Ratio (P/E) of 12, which is at the lower end of Apple’s historical forward P/E (currently at approx. 17). Morgan Stanley is not the only firm revising their prices upwards, earlier Piper Jaffray and recently Oppenheimer & UBS also have revised their target prices for AAPL. I am sure, others institutions will soon follow suit. IF Ms. Huberty’s price predictions for 2013 come true, that would give Apple Inc. a market valuation to the tune of a mythical $1 trillion!

Wall Street is in a whirlwind after disgruntled Goldman Sachs executive, Greg Smith, tendered his

Wall Street is in a whirlwind after disgruntled Goldman Sachs executive, Greg Smith, tendered his

I have always said if there ever came a day when I could no longer meet my duties and expectations as Apple’s CEO, I would be the first to let you know. Unfortunately, that day has come.

I have always said if there ever came a day when I could no longer meet my duties and expectations as Apple’s CEO, I would be the first to let you know. Unfortunately, that day has come.